Press Release

31st July 2019

Analysis of Assets and Liabilities of National Parties - FY 2016-17 & 2017-18

Complete report containing Party-wise information related to assets, liabilities and capital is attached in English. Executive Summary of report in Hindi is also attached for your reference.

Introduction

There are a set of accounting standards set for commercial, industrial and business enterprises and these accounting standards are issued by the Institute of Chartered Accountants of India (ICAI). Political parties fall under the non-commercial, non-industrial or non-business entity. Thus, the standard accounting formats of the other entities are not applicable to political parties.

The Election Commission of India (ECI) requested for recommendations from the ICAI to bring uniformity in the accounting and auditing practices of political parties. Thus, the “Guidance note on Accounting & Auditing of political parties” or the “Accounting guidelines” were formulated in February, 2012 by the ICAI on the request of the ECI, in order to improve accounting and auditing standards of political parties and improve transparency in their finances. These guidelines lay down principles of recognition, measurement and disclosure items of income, expenditure, assets and liabilities in the financial statements of political parties.

Association for Democratic Reforms (ADR), in its previous report dated 16th October, 2017, analysed the assets and liabilities declared by the seven National Parties (BJP, INC, NCP, BSP, CPI, CPM and AITC) between FY 2004-05 and 2015-16.

This report analyses the assets and liabilities declared by the 7 National Parties (BJP, INC, NCP, BSP, CPI, CPM and AITC) between FY 2016-17 and 2017-18.

To access the report on website, please go to: https://adrindia.org/content/analysis-assets-liabilities-national-parties-%E2%80%93-fy-2016-17-and-2017-18

Executive Summary

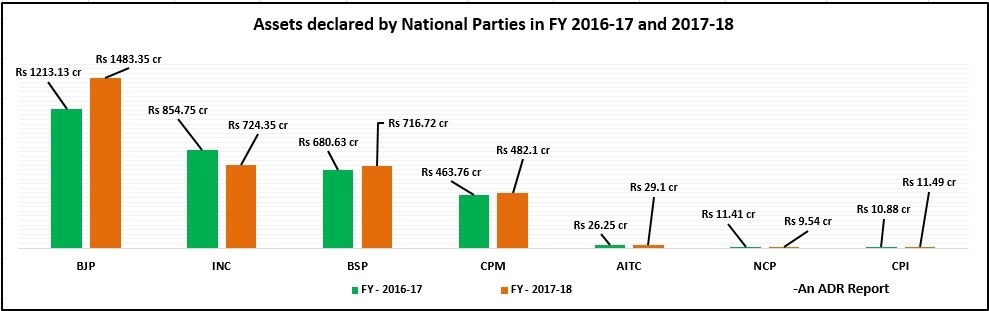

Declaration of assets by the National Parties – FY 2016-17 & 2017-18

- The total assets declared by the 7 National Parties during FY 2016-17 amounted to Rs 3260.81 cr which increased by 6% to Rs 3456.65 cr during FY 2017-18.

- During FY 2016-17, the declared assets of BJP totaled Rs 1213.13 cr and increased by 22.27% to Rs 1483.35 cr during FY 2017-18.

- INC and NCP are the only 2 National Parties to show a decrease in their annual declared assets. The total assets of INC between FY 2016-17 & 2017-18 decreased by 15.26% (from Rs 854.75 cr to Rs 724.35 cr) and that of NCP decreased from Rs 11.41 cr to Rs 9.54 cr (by 16.39%).

- The total assets of AITC increased from Rs 26.25 cr during FY 2016-17 to Rs 29.10 cr, an increase of 10.86%.

Chart: Total Assets declared by National Parties, FY 2016-17 and 2017-18

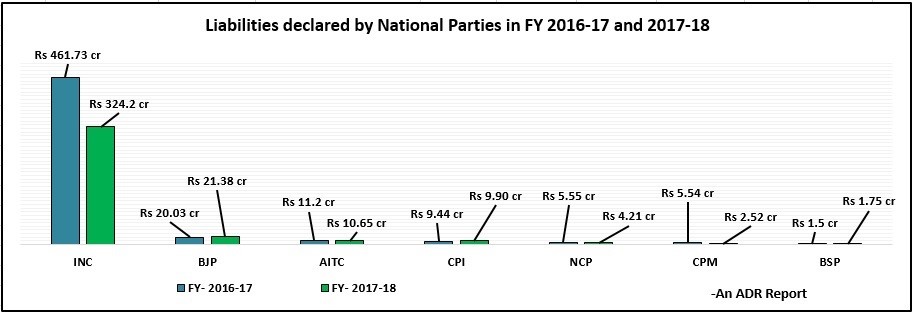

Declaration of liabilities by National Parties – FY 2016-17 & 2017-18

- The total liabilities for FY 2016-17 declared by the National Parties amounted to Rs 514.99 cr (an average of Rs 73.57 cr per party) which decreased by 27.26% to Rs 374.61 cr in FY 2017-18.

- For FY 2016-17, INC declared the highest liabilities of Rs 461.73 cr followed by BJP with Rs 20.03 cr.

- For FY 2017-18, highest liabilities of Rs 324.2 cr are declared by INC followed by Rs 21.38 cr in case of BJP and Rs 10.65 cr in case of AITC.

- Between FY 2016-17 and 2017-18, four parties declared a decrease in liabilities, INC (decrease of Rs 137.53 cr), CPM (decrease of Rs 3.02 cr), NCP (decrease of Rs 1.34 cr) and Rs 55 lakhs liabilities decrease of AITC.

- BJP, CPI and BSP have declared an increase in liabilities during FY 2017-18.

Chart: Total Liabilities declared by National Parties, FY 2016-17 & 2017-18

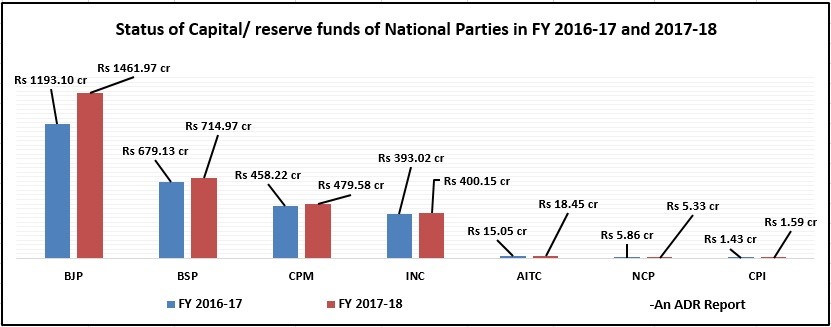

Capital declared by National Parties – FY 2016-17 & 2017-18

- The total Capital/ Reserve fund set aside by the National Parties during FY 2016-17 was Rs 2745.81 cr, and Rs 3082.04 cr for FY 2017-18, after adjusting for liabilities for the respective years, from the total assets of the parties.

- For FY 2017-18, BJP has the highest capital at present after declaring Rs 1461.97 cr followed by Rs 714.97 cr of BSP and Rs 479.58 cr of CPM.

- During FY 2016-17, CPI has the least declared capital fund of Rs 1.43 cr followed by NCP with Rs 5.86 cr.

Chart: Status of capital/reserve funds of National Parties, FY 2016-17 & 2017-18

Recommendations of ADR

1. Changing of auditors every three years:

- The amended Companies Act, 2013, which came into force on 29th Aug, 2013, stated that no Company shall have an auditor for more than 5 years but this rule was not applied for political parties. Once a firm/person is responsible for auditing of accounts of parties for long duration, there is a possibility that finances of parties could be made as opaque as possible.

- Indian laws do not permit foreign auditing firms to operate directly in India but might have a tie-up with domestic auditing firms. This becomes a worrisome factor if the domestic firm is auditing Indian parties’ accounts. By having no provision to change auditors frequently, foreign companies might have a bird’s eye view of the parties’ internal accounting.

- The accounts of political parties should be “audited by a qualified and practicing Chartered Accountant from a panel of such accountants maintained for the purpose by the Comptroller and Auditor General.” This differs from the current practice where political parties choose their auditors entirely on their own.

2. As the income-expenditure statements of political parties are assessed rarely (even those of National Parties), authenticity of the accounts submitted remains doubtful. When the authenticity is not verified, the auditors who might be under-reporting the accounts, remain out of purview of punishment. With online submission of IT Returns, political parties do not submit details of income, expenditure and assets and liabilities as attachments. Thus, the IT department too does not have enough information on the finances of political parties. Annual scrutiny of documents submitted by political parties is recommended.

3. The 170th Law Commission report recommended introduction of Section 78A in the Representation of the People Act, 1951 and proposed penalties for political parties defaulting in the maintenance of accounts. This needs to be introduced and implemented.

4. Section 276CC of the IT Act penalizes individuals who fail to submit their IT returns. Similar legal provisions should be applicable to political parties too. Supreme Court judgement in Common Cause vs. Union of India & ors. had stated that when parties default in filing their returns, prima facie they violate provision of IT Act. For both FY 2016-17 and 2017-18, BJP, INC, CPI & NCP delayed the submission of their audit reports. For FY 2016-17, BJP delayed its submission by 99 days and INC was the last to submit its audited account after a delay of 138 days. For FY 2017-18, INC was the last to submit its audited report after 76 days.

Please Note: For any queries related to the attached reports, please contact at +91 9910114320

Contact Details

|

+91 80103 94248, Email: [email protected] |

Head – ADR/NEW +91 11 4165 4200 +91 88264 79910 |

IIM Ahmedabad (Retd.) Founder Member- ADR/NEW +91 99996 20944 |

IIM Bangalore Founder Member- ADR/NEW +91 94483 53285 |