Press Release

Date: 9th March, 2018

Analysis of Assets & Liabilities of Regional Parties – FY 2011-12 to 2015-16

Introduction

There are a set of accounting standards set for commercial, industrial and business enterprises and these accounting standards are issued by the Institute of Chartered Accountant of India (ICAI). Political parties fall under the non-commercial, non-industrial or non- business entity. Thus, the standard accounting formats of the other entities are not applicable to political parties.

The Election Commission of India (ECI) requested for recommendations from the ICAI to bring uniformity in the accounting and auditing practices of political parties. Thus, the “Guidance note on Accounting & Auditing of political parties” or the “Accounting guidelines” were formulated in February, 2012 by the ICAI on the request of the ECI, in order to improve accounting and auditing standards of political parties and improve transparency in their finances. These guidelines laid down principles of recognition, measurement and disclosure items of income, expenditure, assets and liabilities in the financial statements of political parties.

This report analyses the assets and liabilities declared by the 22 Regional Parties between FY 2011-12 and 2015-16 – AAP, AGP, AIADMK, AIFB, BPF, DMDK, DMK, JKPDP, JDS, JDU, JMM, JVM(P), LJP, MNS, RLD, SAD, SFD, Shiv Sena (SHS), SP, TDP, TRS, YSR-Congress.

Executive Summary

Frequently asked questions

- What is a balance sheet?

Balance sheet contains information on three main financial aspects of the entity, which is a political party in this case. a) The “Assets” of the party are resources such as cash, their bank investments, moveable and immovable properties, vehicles, etc.; b) The “Capital” or “Reserve Fund” portion of the balance sheet is the accumulated wealth of the political party which is essentially assets minus any liabilities of the party; c) The “Liabilities” of a political party includes borrowings from banks, unsecured loans, access to overdraft facilities, etc.

- What is special about assets and liabilities/ income & expenditure of political parties?

The accounting standards were created keeping in mind the nature of activities of the entities, be it commercial, industrial or business. While political parties do not perform any commercial activities, the purpose of the accounting standard i.e. maintain uniformity in presentation, is kept intact by merely modifying the terminology such as “Income and Expenditure” in place of “Profit and Loss”.

- What are ECI’s transparency guidelines?

Article 324 of the Constitution empowers the ECI with plenary powers which was established in the Supreme Court judgement (AIR 1978 SC 851) by stating that the Commission has the powers to fill any legal vacuum so as to promote free and fair elections. The transparency guidelines, circulated in 2014, were lawful instructions issued after consultation with all recognised parties and hence are binding. These guidelines were formulated to improve financial transparency in political parties and strongly advised the parties to follow the ICAI guidelines formulated and circulated in February, 2012.

- What information is captured in this report?

The assets, liabilities and capital declared by the 22 Regional Parties (Annexure-1) between FY 2011-12 and 2015-16 have been taken up for analysis in this report. The assets include fixed assets, loans & advances, deposits made, investments, etc. while the liabilities include bank borrowings, sundry creditors, overdrafts, other liabilities, etc. The capital/ reserve fund is the amount set aside by the parties after subtracting liabilities from the total assets, every year, for party expenditure.

Declaration of assets by the Regional Parties – FY 2011 to 2015-16

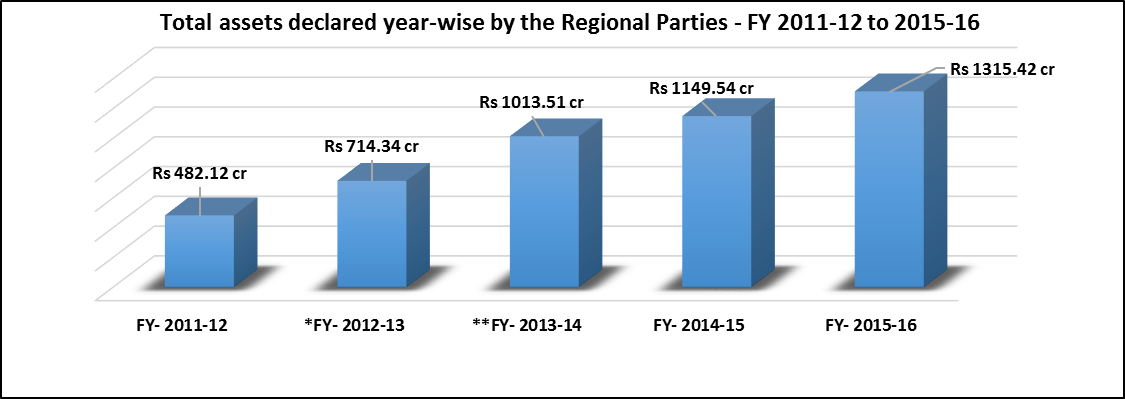

- The average total assets declared by the 20 Regional Parties during FY 2011-12 was Rs 24.11 cr which increased to Rs 65.77 cr during FY 2015-16.

- YSR Congress was registered in March, 2011 and AAP was registered in November, 2012. The average assets declared by the these two parties during FY 2012-13 was Rs 1.165 cr which increased to Rs 3.765 cr during FY- 2015-16.

*The balance sheet of AGP, BPF, JKPDP, JMM, JVM-P, MNS and TRS for the FY 2012-13 is unavailable in the public domain

**The balance sheet of TRS for the FY 2013-14 is unavailable in the public domain

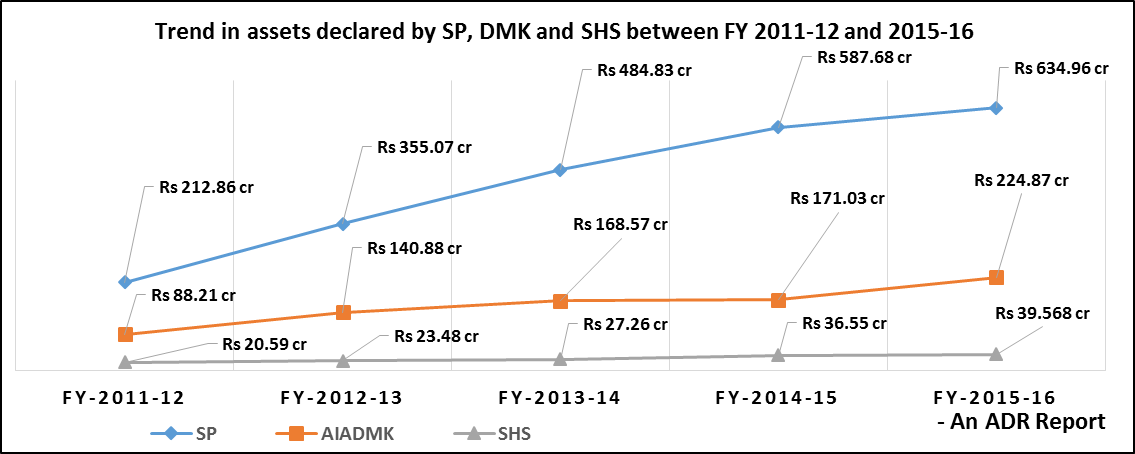

- During FY 2011-12, the declared asset of SP was Rs 212.86 cr which increased by 198% to Rs 634.96 cr during FY 2015-16.

- SP, AIADMK, AIFB and SHS are the only major Regional Parties to show a steady increase in their annual declared assets. The total assets of AIADMK between FY 2011-12 & 2015-16 increased by 155% (Rs 88.21 cr to Rs 224.87 cr) while that of SHS increased from Rs 20.59 cr to Rs 39.568 cr (by 92%).

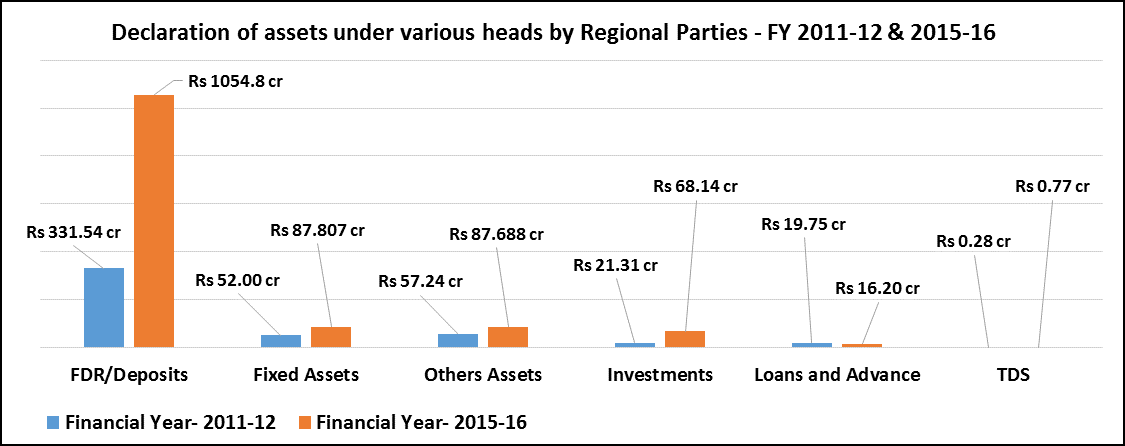

- The assets declared by Regional Parties fall under 6 major heads: fixed assets, loans & advances, FDR/ deposits, TDS, Investments and other assets.

- During FY 2011-12, the Regional Parties declared maximum assets under FDR/ deposits which amounted to Rs 331.54 cr (68.77% of total assets) which increased to Rs 1054.80 cr (80.19% of total assets) in FY 2015-16.

- It is to be noted that the only asset category to show a reduction in value was “Loans and Advance”. During FY 2011-11, parties invested a total of Rs 19.75 cr whose current value stands at Rs 16.20 cr.

Declaration of liabilities by Regional Parties – FY 2011-12 to 2015-16

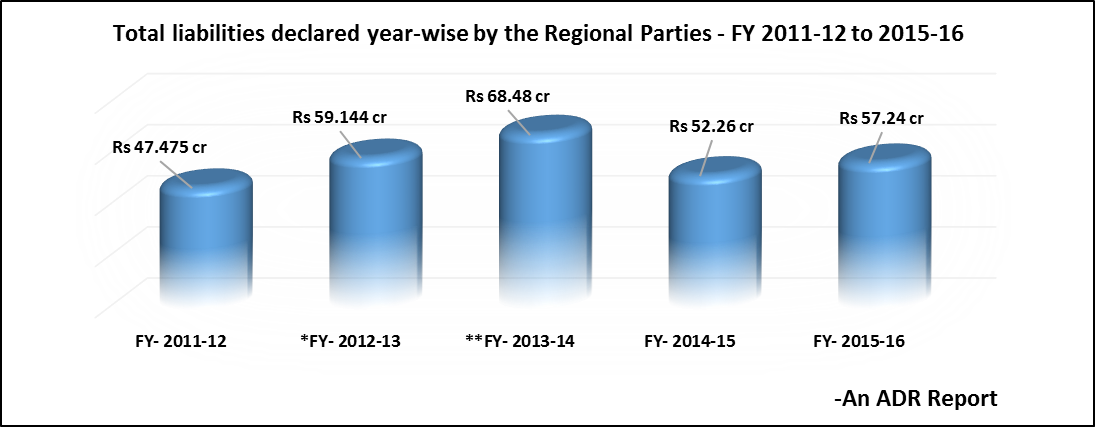

- The total liabilities declared by the 20 Regional Parties (whose details are available for both FY 2011-12 & 2015-16), was Rs 47.475 cr during FY 2011-12 which increased to Rs 52.21 cr during FY 2015-16.

- Rs 2.37 cr was the average liability per party during FY 2011-12, while it was Rs 2.61 cr per party during FY 2015-16.

- Total liabilities of YSR-C and AAP for FY 2012-13 was Rs 1.86 cr (an average of Rs 93 lakh per party) and that for FY 2015-16 was Rs 5.03 cr (an average of Rs 2.515 cr per party).

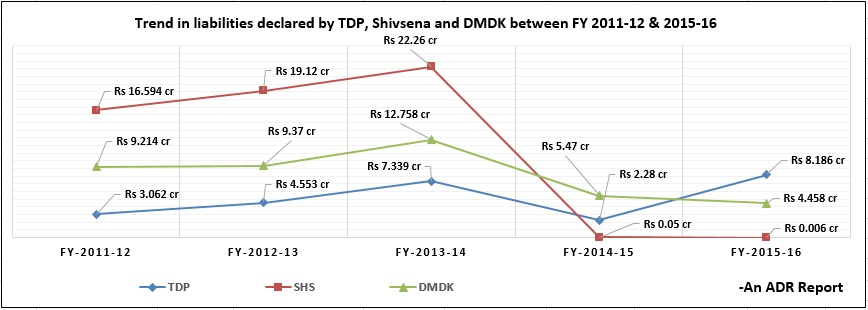

- During FY 2011-12, SHS declared the highest total liabilities of Rs 16.594 cr followed by DMK with Rs 9.214 cr.

- Highest liabilities during FY 2015-16 was declared by TRS (Rs 15.97 cr) but the party had declared NIL liabilities during FY 2011-12. Second highest liabilities was declared by TDP with Rs 8.186 cr.

- Between FY 2013-14 and 2014-15, liabilities of Shivsena reduced by 99.78% (Rs 22.21 cr) while that of TDP increased by 259% (Rs 5.906 cr) between FY 2014-15 and 2015-16.

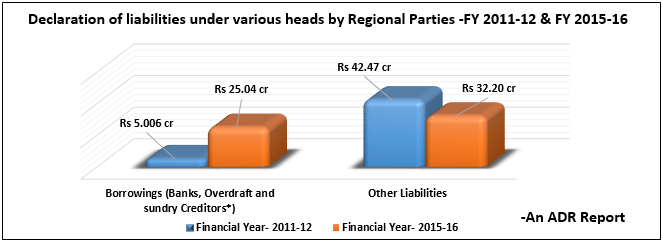

- The liabilities declared by Regional Parties fall under 2 major heads: Borrowings (from banks, overdraft facilities and sundry creditors) and other liabilities.

- Between FY 2011-12 and 2015-16, the Regional Parties declared a decrease in liabilities under “other liabilities” - Rs 42.47 cr (FY 2011-12) to Rs 32.20 cr (FY 2015-16). Liabilities under “borrowings” showed an increase of 400% or Rs 20.034 cr between FY 2011-12 (Rs 5.006 cr) and FY 2015-16 (Rs 42.47 cr).

- 12 Regional Parties have declared NIL borrowings for FY 2011-12 while 9 parties declared NIL borrowings during FY 2015-16.

Capital declared by Regional Parties – FY 2011-12 to 2015-16

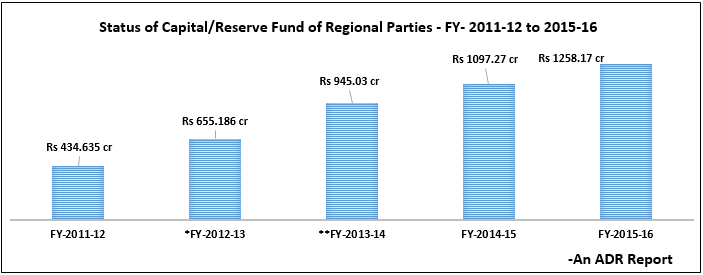

- The total Capital/ Reserve fund set aside by the Regional Parties during FY 2011-12 was Rs 434.635 cr, which increased by Rs 823.535 cr (189.48%) to Rs 1258.17 cr during FY 2015-16.

- Between FY 2014-15 & 2015-16 the Capital declared by Regional Parties increased by 14.66% or Rs 160.90 cr.

*The balance sheet of AGP, BPF, JKPDP, JMM, JVM-P, MNS and TRS for the FY 2012-13 is unavailable in the public domain

**The balance sheet of TRS for the FY 2013-14 is unavailable in the public domain

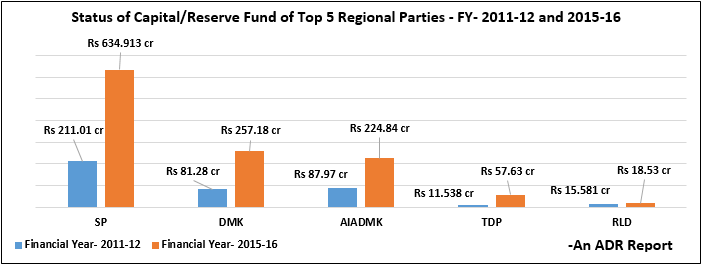

- SP has the highest capital of Rs 634.913 cr during FY 2015-16 followed by Rs 257.18 cr of DMK and Rs 224.84 cr of AIADMK.

- TDP declared total capital fund of Rs 11.538 cr during FY- 2011-12, which increased to Rs 46.09 cr during FY- 2015-16, an increase of Rs 34.552 cr or 299%.

Observations & Recommendations of ADR

Observations

- According to the ICAI guidelines, parties are directed to declare details of the financial institutions, banks or agencies from whom loans were taken. The guidelines specify that the parties should state the “terms of repayment of term loans” on the basis of due date such as a year, 1-5 years or payable after 5 years – not declared by the Regional Parties.

- Details of loans given by the parties in cash/ kind should be specified and if it constitutes more than 10% of the total loans, nature and amount of such loans should be declared specifically by the parties - not declared by the Regional Parties.

- ICAI guidelines on auditing of political parties which were also endorsed by the ECI in order to improve transparency in the finances of political parties, remain guidelines only and have not been actively taken up by the political parties as a mandatory procedure to disclose details of their income. These guidelines were meant to standardize the format of financial statements of parties apart from improving disclosureof income, expenditure, assets and liabilities of the unique association, political parties. Details of disclosure included:

- Classification and disclosure of details of donors (individuals, companies, institutions and others) – classification not declared by the Regional Parties.

- Revenue from issuance of coupons of different denominations to be disclosed separately – not declared by the Regional Parties.

- Changing of auditorsevery three years:

- The amended Companies Act, 2013, which came into force on 29th Aug, 2013, stated that no Company shall have an auditor for more than 5 years but this rule was not applied for political parties. Hence, designating a firm/person for auditing of accounts of parties for long durations is not desirable as there is a feasibility of making finances of parties as opaque as possible.

- Indian laws do not permit foreign auditing firms to operate directly in India but they might have a tie-up with domestic auditing firms which may enable foreign companies to have access to the parties’ internal accounting.

- The 255th Law Commission report has recommended that the accounts of political parties be “audited by a qualified and practicing Chartered Accountant from a panel of such accountants maintained for the purpose by the Comptroller and Auditor General.” However as per the current practice, political parties choose their auditors entirely on their own. This needs to change.

- As the income-expenditure statements of political parties are assessed rarely (even those of National Parties), authenticity of the accounts submitted remains doubtful. When the authenticity is not verified, the auditors who might be under-reporting the accounts, remain out of purview of punishment. With online submission of IT Returns, political parties do not submit details of income, expenditure and assets and liabilities as attachments. Thus, the IT department too does not have enough information on the finances of political parties! Annual scrutiny of documents submitted by political parties is recommended.

- The 170th Law Commission report recommended introduction of Section 78A in the RPA and proposed penalties for political parties defaulting in the maintenance of accounts. This needs to be introduced and implemented.

Recommendations

Section 276CC of the IT Act penalizes individuals who fail to submit their IT returns. Similar legal provisions should be applicable to political parties too. Supreme Court judgement in Common Cause vs. Union of India & ors. had stated that when parties default in filing their returns, prima facie they violate provision of IT Act.