Was it the party in power at the centre that benefited more from electoral bonds or did the parties in power in the states benefit? Can one see a pattern in the economic characteristics of the states that saw a greater flow of funds through bonds? An analysis of the bond data gives some answers.

The way political parties raise money is a matter of controversy in all democratic countries. India is no exception. The worry is that the power of the rich and powerful would run counter to the basic democratic ideal of “one person one vote”. Any discussion of the role of money in politics is fraught with people’s notions of what should happen in an ideal world versus the murky world of government decisions – policies, contracts, leases, concessions, and enforcement of rules and regulations – being up for sale.

The first view is idealistic. Money is needed for election campaigns, and to the extent individuals want to express their support for specific political parties for reasons of ideology or policy-orientation via campaign contributions, there should be room for monetary support. Indeed, this is the case in all democratic countries. The question is, does the electoral funding system create a level playing field so that all voters get a chance to express their views by supporting and funding candidates of their choice or do the rich enjoy a disproportionate advantage and do businesses use political funding to advance their economic interests?

The electoral bond issue in India has added a fair bit of fuel to this debate. The arguments of the opponents are mainly two. First, there was no upper limit on giving money through electoral bonds. Second, the identity of the donor was anonymous. That is, any person or organisation could buy a bond of any amount, give it to the party of his or her choice, and that party could redeem the bond and cash in the money to add to its chest of funds. There was was no way for the public or the Election Commission of India to know whether that money came from the pockets of an industrialist or a lobbying firm or an ordinary supporter. Moreover, some have noted that electoral bonds gave whichever party was in power at power at the centre a disproportionate advantage in attracting funds as the central government controlled all the institutions that could monitor and trace financial transactions.

A deeper investigation reveals that bonds are creating an unprecedented inequality, at one level between BJP and non-BJP parties, but at a deeper level amongst the non-BJP parties.

The concern that taking advantage of these two features of the bonds – no upper bound and anonymity – large industrialists could influence the government in exchange for money was at the heart of the lawsuit that civil society groups filed with the Supreme Court. Just a few months before the recently concluded 2024 national elections, the Supreme Court ruled that electoral bonds were unconstitutional and instructed the State Bank of India (SBI) –which issued and encashed the bonds – to publish the full list of donors and recipients of these bonds.

After the list of donors of electoral bonds was released to the public, information emerged in the news and social media that seemed to confirm the apprehensions about their misuse. There have been news reports and analyses to suggest that many companies that have donated money via electoral bonds had financial losses on their balance sheets, and that for many companies, their bond purchases were higher than their profits (Bose 2024). There were also analyses which showed that companies that paid money through bonds after the Central Bureau of Investigation (CBI) and the Enforcement Directorate (ED) knocked on their doors.

In this essay, we will look at three issues based on a preliminary analysis of the data that has been made publicly available. First, which are the political parties that have got money through the bonds and has the inflow of money through these bonds been so large that it has made other forms of political contributions irrelevant? Second, was it the party in power at the centre that benefited more from the bonds or did the parties in power in the states benefit? And third, can one make some inferences about what kind of states in terms of their economic characteristics have seen a greater flow of funds through electoral bonds?

We use data from two sources. One of them is the data published by SBI which contains information on all bonds till January 2024. The other is a report published by the Association for Democratic Reforms (ADR) which provides data on how much a party reported as receiving in bonds and other forms of donations between 2016–17 and 2021–22. This report has been prepared based on annual reports submitted to the ECI by various national and regional parties about the funds they receive. There are some differences in the data between the two sources in terms of the time frame and details about the sources of funds, but qualitatively the picture that emerges from these two sources is consistent.

It should be noted that the ADR only compiles reported funds since these are what parties disclose to the ECI. Judging by anecdotal accounts of massive unreported spending in elections, which far exceeds the amounts received through official channels like electoral bonds, unreported funds appear to be substantial and largely unknown. Therefore, our analysis can only provide a partial picture of the process of financing of political parties but hopefully adds some insights to the extent one can learn something about icebergs, especially their movements and variations, from studying their tip.

When a party comes to power in more states, the amount of bond money coming its way increases.

Understanding the scope and coverage of the data is critical for understanding the structure of our analysis. In the matched bond data that we have downloaded from the Dataful website , each row in the data matrix represents a transaction. For each transaction the following information is recorded: the name of the donor, type of the donor (individual/organisation), the name of the encashing party, date of purchase of the bond (we call it the issue date), the name of the state where the bond was issued (we call it the issue state), date of encashment of the bond (we call it the pay date), the state in which the bond is paid (we call it the pay state), amount of the transaction, denomination of the bonds (Rs 1 crore, Rs 10 lakh etc). 1

The SBI data reveals the names of the purchaser of the bonds and the name of the recipient political party. Besides the names of the parties, we have two types of state names (issue/pay) and two types of dates (issue/pay). Our analysis is based on issue-states and issue-dates. The use of issue-states requires certain caveats. In many cases, donors bought bonds from cities such as Delhi and Mumbai and donated them to regional parties.

For example, Future Gaming purchased bonds from Chennai, Mumbai and Delhi and gave them to different parties such as the BJP, the DMK and the AITC. The bonds for the BJP were paid out at the Delhi branch of SBI, the DMK encashed them in Chennai and the AITC encashed them in Kolkata.

One can see that the regional parties are encashing the bonds in their home states while national parties are encashing them in Delhi. We know the home state of regional parties and they are usually electorally successful in their home state. There is no way to know in which state the national parties are spending their money. Therefore, pay-state information does not reveal any extra information.

But issue-state information reveals the local character of the donors. Again, donors are also likely to purchase the bonds from their home state. If it is a national player, it is more likely to purchase the bond from Delhi or Mumbai. If local, they are more likely to buy from their main state of operation. The cross-border movement of funds is a major part of our analysis. When we identify a transaction as a cross-border one, we essentially mean that the issue state is different from the home state of the recipient political party. This can only be done for regional parties.

Now we turn to answering the questions we posed above, one by one.

A few stylised facts about funding of parties

We first look at the basic pattern of sources of funds declared by political parties, showing both how much of a given form of funding is going to a specific party, and how much of that party’s funding as declared to the Election Commission comes from bonds as opposed to non-bond sources.

From the ADR report we can see that between 2016–17 and 2021–22, about 56% of the total funds legally received by political parties came from electoral bonds, about 28% came from corporate donations (including electoral trusts) and 16% from other sources (private donations, members' subscriptions, collections from meetings, etc). It should be noted that the earliest bond data recorded in the SBI list is from 2019. Therefore, it is expected that over time the relative importance of funds through bonds will increase.

But are bonds making non-bond forms of donations irrelevant? There is no straightforward answer to this question.

The amount of both bond and non-bond donations to the BJP is huge. Between 2016–17 and 2021–22, the BJP alone received more than Rs 5,000 crore through bonds, while all the other parties together got about Rs. 3,000 crore. That is, about 57 % of electoral bond money went to the BJP. But this supremacy of BJP also applies to non-bond forms of donations – Rs. 4,850 crore, while all other parties together got about Rs 2,398 crore. That is, the BJP collected about 66% of donations from non-bond sources. Of corporate donations, the BJP cornered 71%.

The question of incumbency

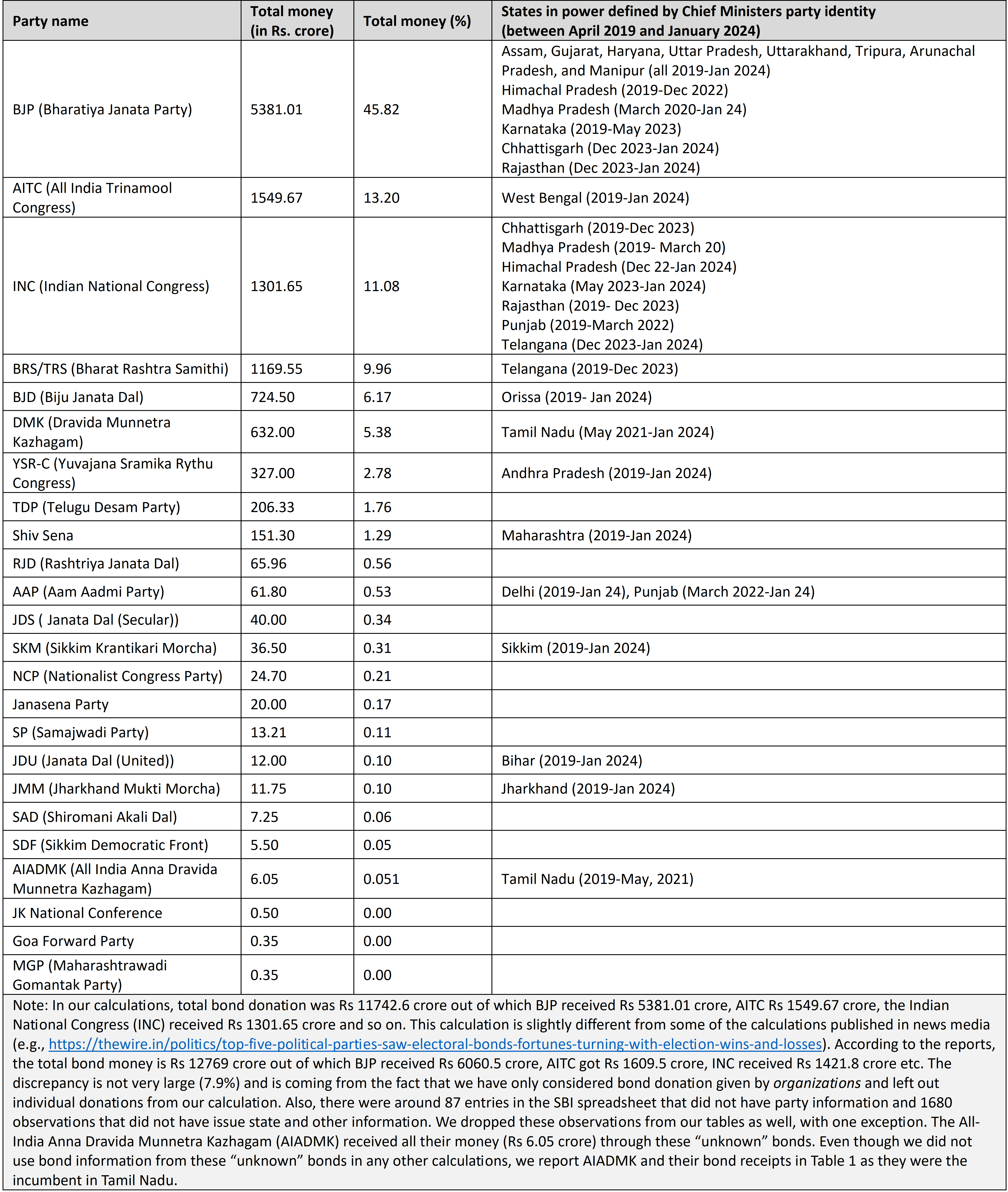

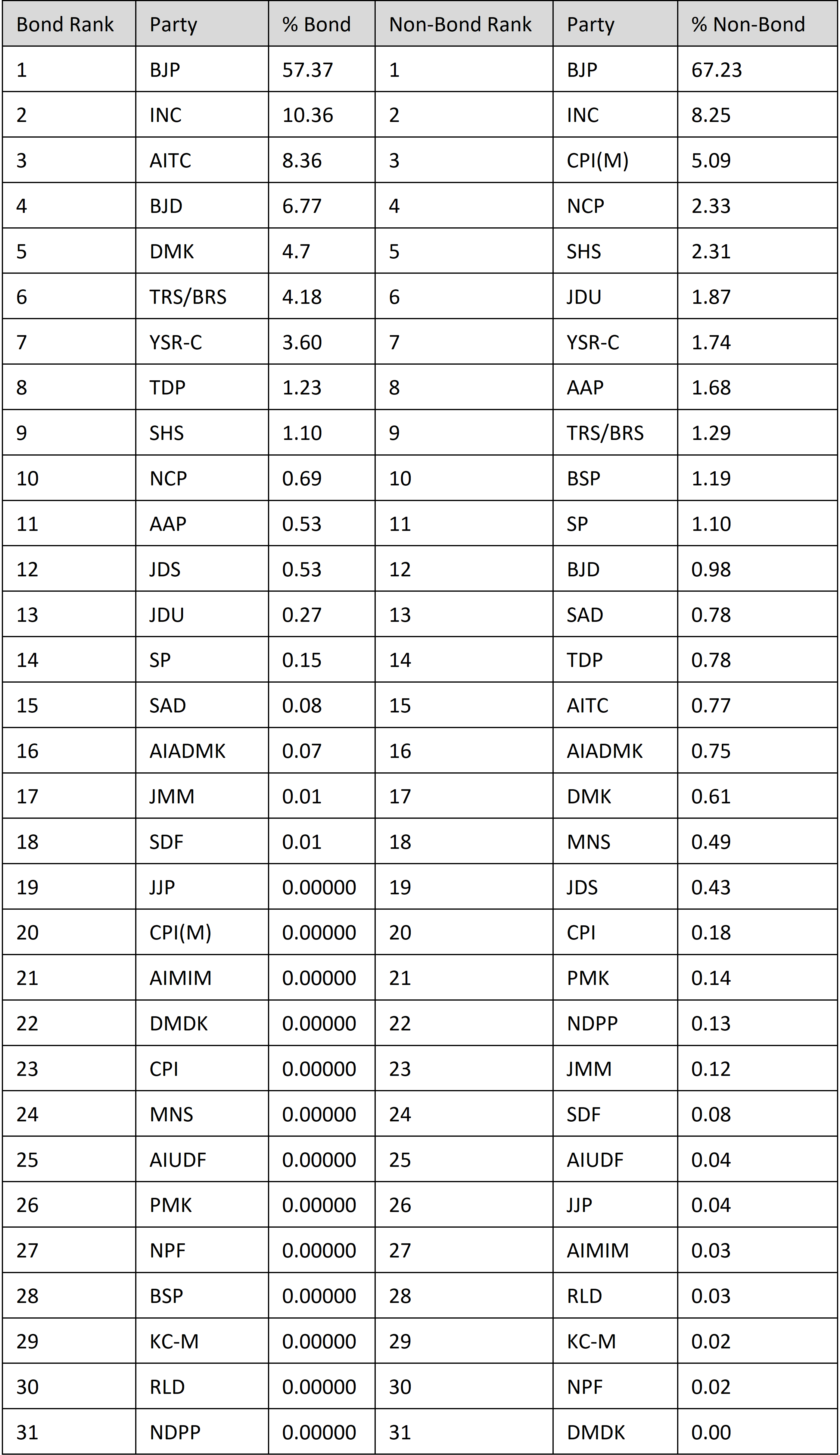

Now we turn to the second question: Were the parties that got money through bonds largely those in power? The following table summarises the answer to this question by providing information on party-wise collections from bonds, and their incumbency status.

Table 1: Ranking of parties by electoral bond donation and incumbency status in states

From Table 1 we find a somewhat loose correlation between bond donation and incumbency status. During our period of data coverage (2019–24), the BJP got the largest amount of money through electoral bonds and they were in power in the most number of states.

But there are some nuances that are worth noting. For example, Trinamool Congress was in power in one state (West Bengal) but it received more money through electoral bonds than Congress which was in power in a larger number of states. Another interesting case is the AIADMK. They were in power in Tamil Nadu between 2019 and 2021 but they could only get Rs 6 crore through electoral bonds.

On the other hand, the TDP was not in power in Andhra Pradesh and yet, ranks seventh with Rs 206.33 crore bond donation which was much higher than AAP (rank 10) which was in power in two states and the JMM which was in power in one state.

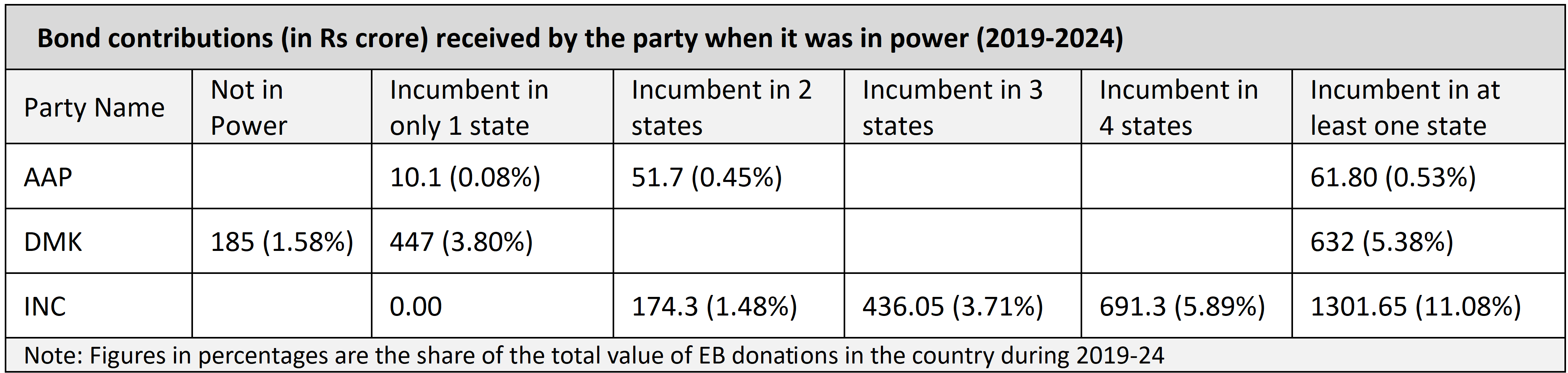

To look at this issue a bit more in depth, we look at the states where the incumbency status changed during this period (2019–24) so that we can examine if a party comes to power in a larger number of states they start receiving a larger amount of bond donations. For this part of the analysis, most of the parties ranking high in the bond list are not of much use as they stayed in power throughout the period. We look at three parties whose incumbency status changed in the middle of our period of study.

Table 2: Incumbency and donations from electoral bonds for AAP, DMK and INC (April 2019-January 2024, in Rs crore)

We see from Table 2 that when a party comes to power in more states, the amount of bond money coming its way increases. For example, even though the DMK managed to get bond funding when it was not in power, the bond collections more than doubled when it came to power in Tamil Nadu. But we see that the degree of increase in bond money when a party comes to power in a larger number of states varies across parties, and the states where it comes to power.

State characteristics and the relative importance of bonds

One reason why we started to think that state characteristics matter to understand the pattern of flow of money through electoral bonds, was the donations received by the Congress. When Congress was in power in Chhattisgarh, Rajasthan, and Himachal Pradesh its total bond contribution was around Rs 206 crore. But when the party won Karnataka alongside being in power in these states, the total bond contribution got almost tripled to make it approximately Rs 600 crore. This could be because Karnataka is much richer than the other three states, and a higher value-added in manufacture.

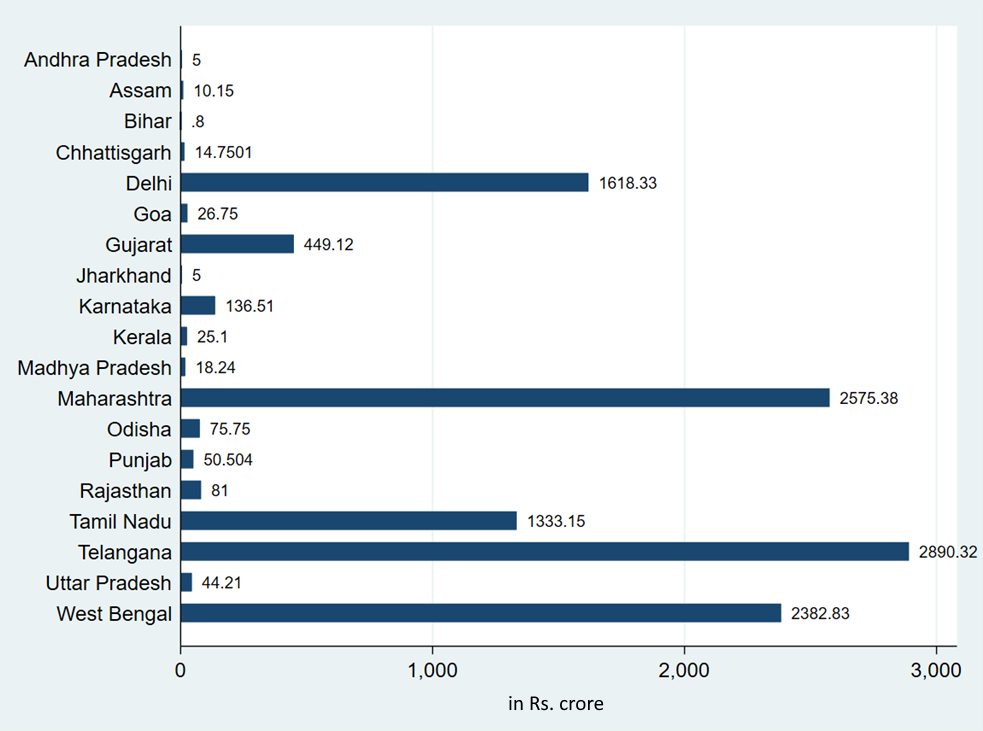

We start by looking at the states from where most of the bond money was generated.

Figure 1: Value of bonds purchased in different states (in Rs. crore)

One can readily see that the bonds were mostly purchased in the more industrial states. For establishing this argument more firmly we use data from the RBI website 2 that gives us the manufacturing net value added (NVA) in different states as a fraction of total all-India NVA in 2021-22, the latest year for which data is available for all major states.

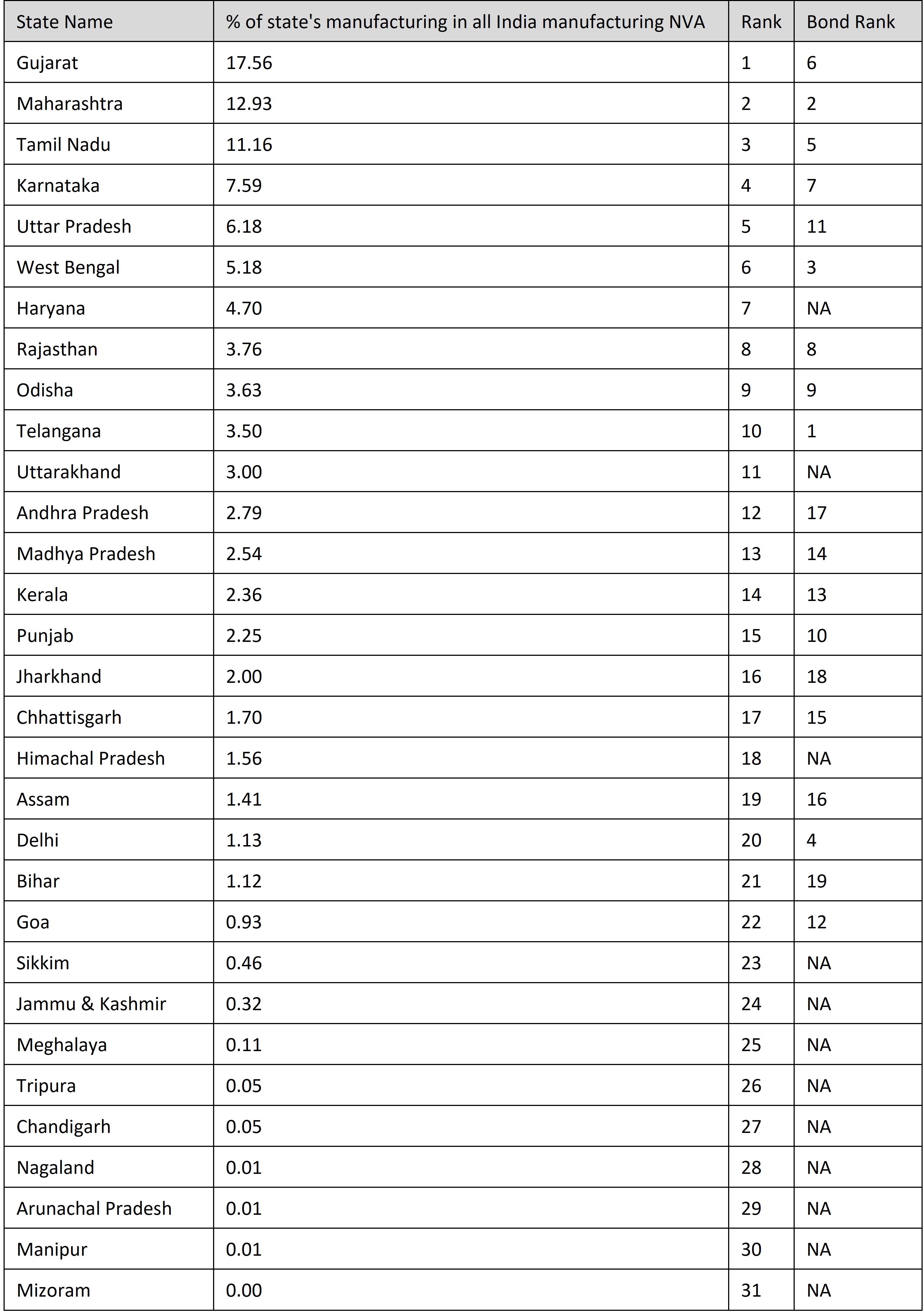

Table 3: Ranks of states in manufacturing value-added and value of electoral bond purchases

In Table 3 the ranking in manufacturing is available for 31 states, while bonds are purchased from only 19 states. We can see that industrial ranking and bond money ranking are positively correlated, with the Spearman’s rank correlation coefficient being 0.61 amongst states where electoral bonds were purchased.

The states which rank high in terms of bond purchased also rank high in industrial ranking (in terms of industrial ranking Gujarat ranks 1, Maharashtra ranks 2, Tamil Nadu ranks 3, West Bengal ranks 6, Karnataka ranks 4, Telangana 10 and Andhra Pradesh 12.) Of course, the correlation is not perfect and nor can one make any causal claims, but it is a pattern that is worth noting.

Fund concentration with a few parties may lead to other parties failing to contest elections effectively in the long run, thereby reducing voter choice and welfare.

But why did more bond money come from the more industrialised states? In other words, why did not resource-based states such as Jharkhand and Punjab see more bond purchases?

We conjecture that the following mechanism is driving the result. Donors donate money in exchange for some favour from the incumbent parties. Purchasing an electoral bond is a way of a direct transaction between the interest group and the political party, and does away with the possibility of paying any middlemen. This mechanism works better in the industrial or the service sector where such middlemen are not essential in the process of rent extraction.

Sectors such as agriculture and mining, on the other hand, are fixed in terms of geography and the process of rent extraction in these sectors often involves local strongmen and a plethora of illegal activities. As money changes hands between the donors and political parties in these sectors, a significant share of the rent goes to these local strongmen. Donations via bonds, in our view, are ways of bypassing these local networks, which is harder where there is rent extraction in agriculture and mining.

However, caution should be exercised while interpreting our result. The theory we proposed here is largely speculative even though it is consistent with the state ranking data. But we need to analyse the nature of the donor companies, their sectors and their headquarter states before making a more conclusive statement, which we hope to take on in future work. It was widely reported in news media that infrastructure companies were major donors. 3 It is possible that infrastructure construction positively is correlated with manufacturing activities. But of course, it may also indicate the possibility of other possible patterns.

The long shadow of electoral bonds

We know that the BJP benefited the most from electoral bonds. Besides the BJP, only a handful of non-BJP parties received large share of bond money. The communist parties announced they would not take money through bonds. Amongst the rest, most of the EB money went to Congress, Trinamool Congress, BJD, DMK, BRS/TRS, TDP and YSR Congress. Besides, Shiv Sena has also received large amount of funds through bonds.

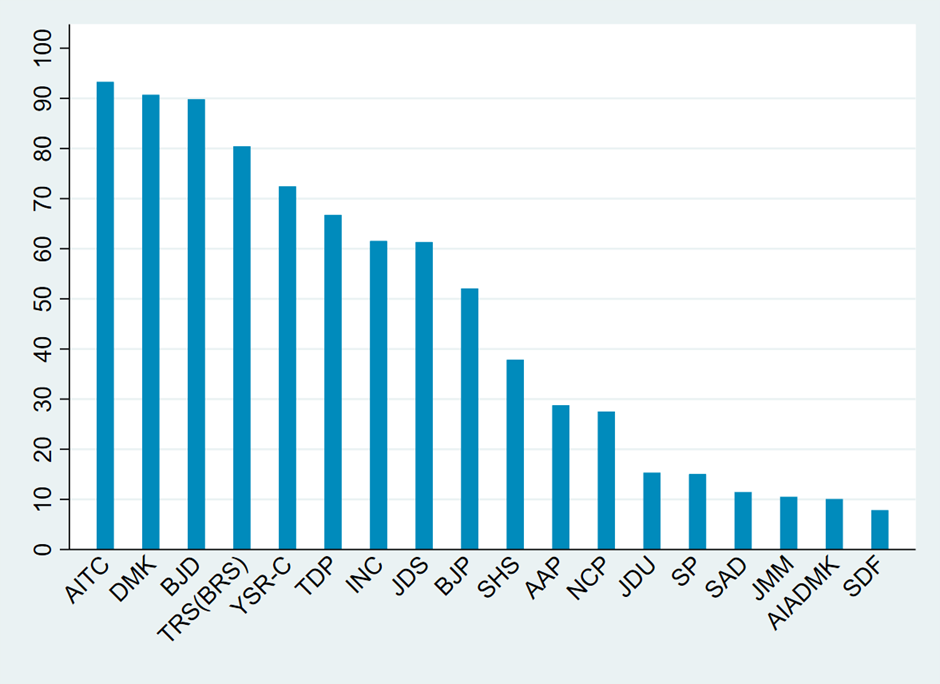

If we look at bond collections as a percentage of the total funds collected as declared by various parties (Figure 2), we see that Trinamool Congress tops the list (93%). It is followed by DMK (90%), BJD (90%), BRS (80%), YSR Congress (72%) and the TDP (67%). The ratios for BJP and Congress are 52% and 61%, respectively.

Figure 2: Electoral Bond collections as a percentage of total declared collections

We find that for non-bond funding the BJP/non-BJP ratio is 2.02 while for bond funding the ratio is 1.34. This would appear to suggest that the BJP has absolute advantage in both bond and non-bond funding, but non-BJP parties have comparative advantage in bond funding. Is it necessarily a bad thing from the point of view democratic processes? After all, bonds seem to be creating a strong footing for non-BJP parties and the recently concluded election results do show that despite its huge advantage in funds, the BJP’s electoral performance was below par, although that was surely driven by many factors and not just fund-related factors.

While at the outset bonds appear to create more equality, a deeper investigation reveals that bonds are creating an unprecedented inequality: at one level between BJP and non-BJP parties, but at a deeper level amongst the non-BJP parties.

Table 4 provides evidence in support of this hypothesis:

Table 4: Importance of bond collection vs non-bond collections

Table 4 shows the distribution of bond and non-bond donations amongst several parties. BJP stands at the top of both lists, receiving 57.37% of bond money and 67.23% of non-bond money, respectively. However, amongst parties other than the BJP, the distribution appears to be more concentrated for bond contributions. While non-bond money went to all 31 parties, bond money only went to 18 parties. This pattern is also confirmed by the coefficient of variation (standard deviation divided by the mean), a standard measure of dispersion – for bond money, the coefficient of variation is 3.2, but it is 3.7 for non-bond money.

The evidence is far from definitive but to the extent it is capturing a certain trend, it is a matter of concern. Concentration exacerbates inter-party inequality, reinforced by the sheer volume of total bond money. The total amount of bond contributions is so high that even a small percentage quickly differentiates a party from non-receivers of the bonds. For example, Congress received 10.35% of bond donations and 8.25% of non-bond donations. In absolute terms, Congress' bond donation receipt is Rs 952.29 crore, was almost one and a half times its non-bond donation receipt of Rs 595.14 crore.

Like the concentration of economic power in the hands of a few corporations, the continued use of electoral bonds could have resulted in further concentration of political power in the hands of a few parties.

Would this kind of inequality impact the political equilibrium of India? In theory, inter-party inequality may have two opposing effects. On the one hand, fund concentration with a few parties may lead to other parties failing to contest elections effectively in the long run, thereby reducing voter choice and welfare. On the other hand, the concentration of political funding amongst a few non-BJP parties may enable them to effectively oppose BJP.

Do the 2024 Lok Sabha election results confirm any of these conjectures? Election outcomes are determined by many factors, and, moreover, chances of electoral success and financing of campaigns affect each other, and so the causality is unlikely to run in any one direction. Still, it may be noted that in states where all major competing parties received bond money, the results were ambiguous. For example, the BJD and BRS did poorly against BJP or Congress, while the DMK and Trinamool performed well against BJP. However, in cases where non-receivers (of bond money) competed against receivers, the results often favoured the receivers. Notable examples include CPI(M), AAP, AIADMK, RJD, and JMM. A major exception is the Samajwadi Party, which won 37 seats against BJP in the last Lok Sabha election despite receiving only a small sum through electoral bonds.

Conclusions

In this age of money-driven politics, the disparity in access to funding raises serious concerns. As noted earlier, we only look at reported funds and we therefore are likely getting a partial picture. With that caveat, to the extent that the trends in political funding suggest a gradual shrinking in the number of parties that can meaningfully compete in elections, the diversity of political platforms could decrease, and the choice before voters will narrow. Just as we have seen lately in India, like the concentration of economic power in the hands of a few corporations, the continued use of electoral bonds could have resulted in further concentration of political power in the hands of a few parties.

On the other hand, parties deprived of bond money could tend to resort to a greater reliance of unreported funds to survive. This would make them vulnerable to the party (or parties) in power at the centre given the latter’s control over the enforcement machinery. Note that three parties did not get much electoral bond funding despite being in power – AIADMK (Tamil Nadu), JMM (Jharkhand) and AAP (Delhi and Punjab). Out of these three, chief ministers of two parties (JMM and AAP) went to jail for corruption charges. The other party, AIADMK, was in a political alliance with BJP between 2019 and 2023.